HKICPA’s over-a-thousand-student survey developed teen money management indicators

(HONG KONG, 28 January 2021) The Hong Kong Institute of Certified Public Accountants (HKICPA) has long had a strong commitment to demonstrating good corporate social responsibility. In celebration of the 15th anniversary of its flagship community project, "Rich Kid, Poor Kid", the Institute conducted the “Teen Money Management Survey 2020” (the “Survey”) of primary and secondary students between September and November 2020. Based on the survey results, the Institute has developed teen money management indicators.

"Financial management education is crucial for the youth, and has been the corporate social responsibility strategic focus of the Institute over the years. Through the Survey, we learned about the consumption habits and payment patterns of Hong Kong’s senior primary school students and junior secondary school students, and explored their money attitudes and understanding in financial management. We hope the data can help identify ways to strengthen financial education. To keep ‘Rich Kid, Poor Kid’ abreast of the time, the Institute has recently released five new volumes of the ‘10 Lessons in Money Management’ comic series for primary school students and their parents. The electronic version has become available on the Institute’s website," said Mr. Raymond Cheng, President of HKICPA.

The “Teen Money Management Survey 2020” was conducted online. Local students from Primary Four to Secondary Three were invited to complete a questionnaire on a voluntary basis through their schools. HKICPA received a total of 1,015 valid responses, of which 15% were from primary students and 85% from secondary students.

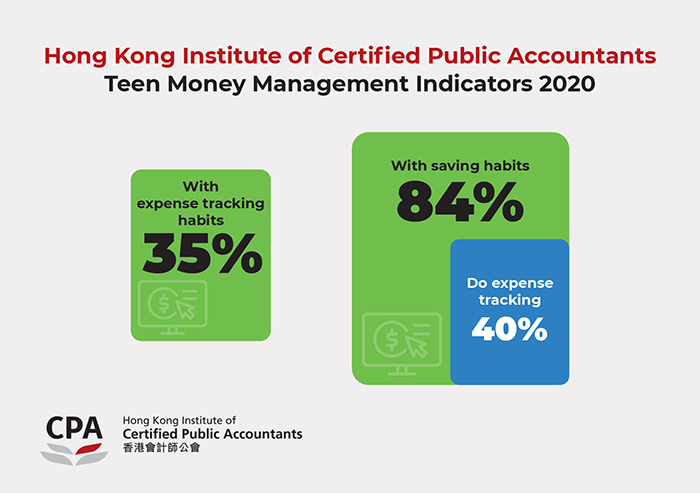

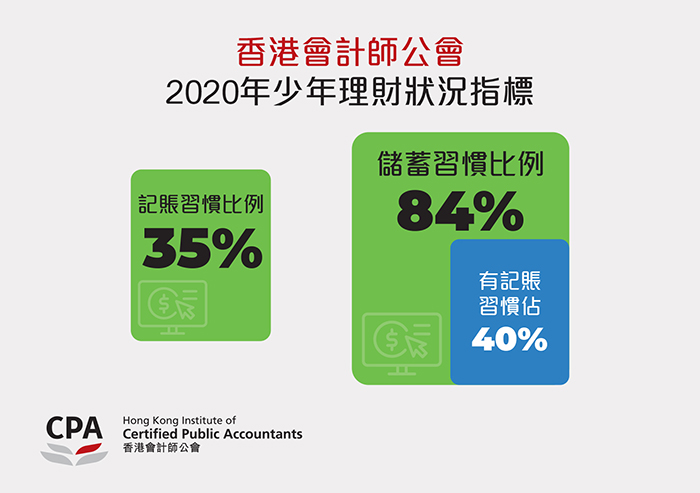

HKICPA believes that saving and expense tracking habits are key components in financial management. Based on the survey results on saving and money management habits, HKICPA has established the "Teen Money Management Indicators 2020". The indicators show that 84% of the respondents have saving habits, reflecting students involve in financial planning to a certain extent. However, among these students with saving habits, only 40% do expense tracking. Overall, of the 1,015 respondents in total, only 35% out of all respondents of the survey have the habit of expense tracking.

Mr. Cheng said, “The Institute believes that the teen money management indicators can serve as a meaningful reference for parents and schools, so that financial education can be implemented responsive to the changing times and needs in daily life, thereby benefiting the young generation. We are happy to see our school age students have a certain level of understanding in money management, but there is still room for improvement in wealth planning and the use of electronic payments.”

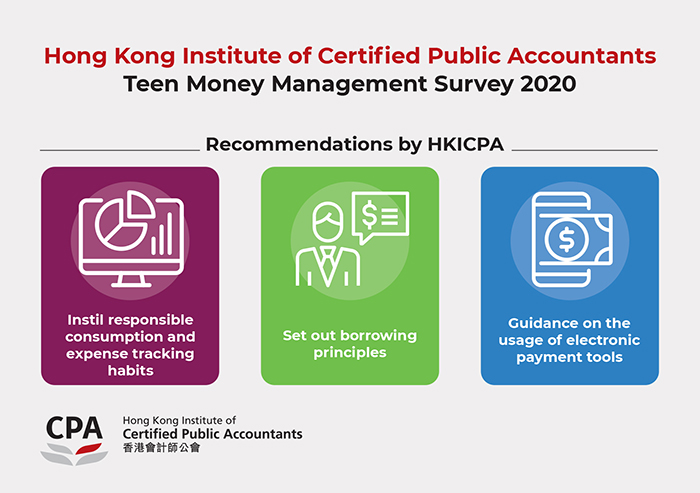

Based on the survey results, HKICPA has the following recommendations:

1. Instil responsible consumption

To help children build up a positive attitude towards money and financial planning, the Institute believes that restrained and responsible consumption must be instilled in financial education. In addition, a full record of income, expenses and savings will be very helpful for students to execute financial planning.

2. Set out borrowing principles

The survey results reflect that many students have experience in borrowing money from others or lending money to others at school. However, borrowing is a concept seldom taught in financial education in general. The Institute recommends to fill the gap by strengthening guidance on lending.

3. Guidance on the usage of electronic payment tools

Electronic payment has gradually become a living habit. The lack of cash involved in transaction may make it difficult for children to grasp the concept of money. The Institute suggests to introduce the basic operation of payment tools with an emphasis on instruction and matters need attention. The Institute also encourages parents and teachers to teach about interest, deposit, debit cards, and credit cards.

For details of the “Teen Money Management Survey 2020”, please visit https://www.hkicpa.org.hk/en/About-us/Corporate-social-responsibility/Community-projects/Rich-Kid-Poor-Kid-programme/Teen-Money-Management-Survey-2020.

About the "Rich Kid, Poor Kid” programme

The Hong Kong Institute of Certified Public Accountants launched the key corporate social responsibility programme “Rich Kid, Poor Kid” in 2005. With the continued support of our Accountant Ambassador members, the Institute encourages them to utilize their unique expertise and skill-sets of CPAs to contribute to society. In the past 15 years, the HKICPA’s “Accountant Ambassadors” volunteered to visit more than 685 primary and secondary schools, held over 829 workshops, and reached more than 148,000 Hong Kong students, educating young children and teenagers on positive financial management concepts and techniques. The “Rich Kid, Poor Kid” programme has been awarded as a "Financial Education Champion" by the Investor and Financial Education Council for three consecutive years.

To keep the programme relevant and practical, the Institute launched a programme revamp adding new elements to the school workshops. Short videos, animations, and five new volumes in the "10 Lessons in Money Management” comic series have been introduced. Through collaboration with the Hong Kong Monetary Authority, the newly-written comic series feature smart tips for parents. The electronic version of the whole comic series is available on the HKICPA's website.

Photo captions:

Mr. Raymond Cheng, President of HKICPA, believes that the teen money management indicators serve as a meaningful reference for parents and schools, so that financial education can be implemented responsive to the changing times and needs in daily life.

"Teen Money Management Indicators 2020" show that 84% of the respondents have saving habits, and only 35% have the habit of expense tracking.

Based on the results of “Teen Money Management Survey 2020”, HKICPA made recommendations on three areas in financial education.

香港會計師公會向逾千中小學生進行調查

設以少年為對象的理財指標

(香港,二零二一年一月二十八日)香港會計師公會一向致力實踐社會責任,於理財教育計劃「窮小子、富小子」慶祝15周年之際,公會在二零二零年九月至十一月向初中及高小學生進行了「2020年少年理財調查」,並按調查結果訂立以少年為對象的理財指標。

香港會計師公會會長鄭中正表示:「理財教育對下一代的成長非常重要,亦是公會多年來實踐企業責任的重點。公會藉調查了解本港初中及高小學生的消費及付款模式趨勢,探討他們的金錢觀及理財認知,希望識別增強理財教育成效的方法。此外,為令『窮小子、富小子』計劃與時並進,公會近期亦針對小學生及家長的需要推出全新五冊的《理財十課》漫畫書,而電子版已上載於公會網站。」

「2020年少年理財調查」以網上問卷形式進行,透過全港中小學邀請小四至中三學生自由參與。公會收到合共1,015份有效回覆,當中小學生佔15%,而中學生佔85%。

公會認為儲錢及記賬習慣是妥善理財的關鍵,特地以調查中有關儲蓄及理財習慣的結果,訂立「2020年少年理財狀況指標」。指標數據顯示,受訪學生中84%有儲蓄習慣,反映學生有一定程度的用錢規劃。然而,有儲蓄習慣的學生中,只有40%人有記賬習慣;而整體受訪學生中,合共僅有35%人有記賬的習慣。

鄭先生說:「公會相信這項以少年為對象的理財指標,能成為家長及學校的有用參考,為小朋友提供更切合時代轉變及生活所需的金錢教育,讓下一代受惠。公會樂見香港少年對金錢及理財有一定的概念,但在財富規劃及使用電子支付方面,仍有進步的空間。」

基於調查結果,公會有以下建議:

1. 灌輸負責任消費的概念

為培養小朋友的正確金錢觀及金錢規劃,公會認為理財教育上必須灌輸有節制、負責任消費的概念。另外,記錄收入、支出及儲蓄,對學生作金錢規劃很有幫助。

2. 教導借貸原則

調查結果反映很多小朋友在求學年齡已有向人借錢或借錢給別人的經驗。然而,普遍的兒童理財教育較少談及借貸;公會建議加強借貸方面的指導,填補這方面的缺口。

3. 指導使用電子付款工具

電子支付已逐漸成為一種生活習慣,當中沒有現錢交易,或會令小朋友更難掌握金錢概念。公會建議可向學生介紹付款工具的基本運作概念,並着重如何使用、使用時要注意的事項。公會亦鼓勵家長及老師教導有關利息、存款及提款卡、信用卡等運作原理的知識。

有關「2020年少年理財調查報告」,詳情請瀏覽https://www.hkicpa.org.hk/en/About-us/Corporate-social-responsibility/Community-projects/Rich-Kid-Poor-Kid-programme/Teen-Money-Management-Survey-2020。

有關「窮小子、富小子」計劃

香港會計師公會於二零零五年推出重點社會責任計劃「窮小子、富小子」,善用會計師獨有的專業知識及技能回饋社會。公會會員以會計師大使身份到訪學校主持工作坊,親身向下一代灌輸正確的金錢價值觀及理財技巧。15年來,計劃已到訪超過685所中小學,舉行逾829場工作坊,惠及超過148,000位學生,並連續三年獲投資者及理財教育委員會頒發「理財教育獎」。

為令「窮小子、富小子」更切合實際需要,公會革新了計劃內容,在學校的工作坊增添了新題材,並製作了短片、動畫,以及推出全新五冊的《理財十課》漫畫書。公會更與香港金融管理局合作,在書冊中提供給爸媽的小貼士,歡迎大家到公會網站瀏覽漫畫書的電子版。

圖片說明:

香港會計師公會會長鄭中正相信,以少年為對象的理財指標,能成為家長及學校的有用參考,為小朋友提供更切合時代轉變及生活所需的金錢教育。

香港會計師公會「2020年少年理財狀況指標」顯示,受訪學生中84%有儲蓄習慣,有記賬習慣的僅有35%。

根據「2020年少年理財調查」,公會建議加強以上三個範疇的理財教育。